Top Forex Reversal Patterns that Every Trader Should Know Forex

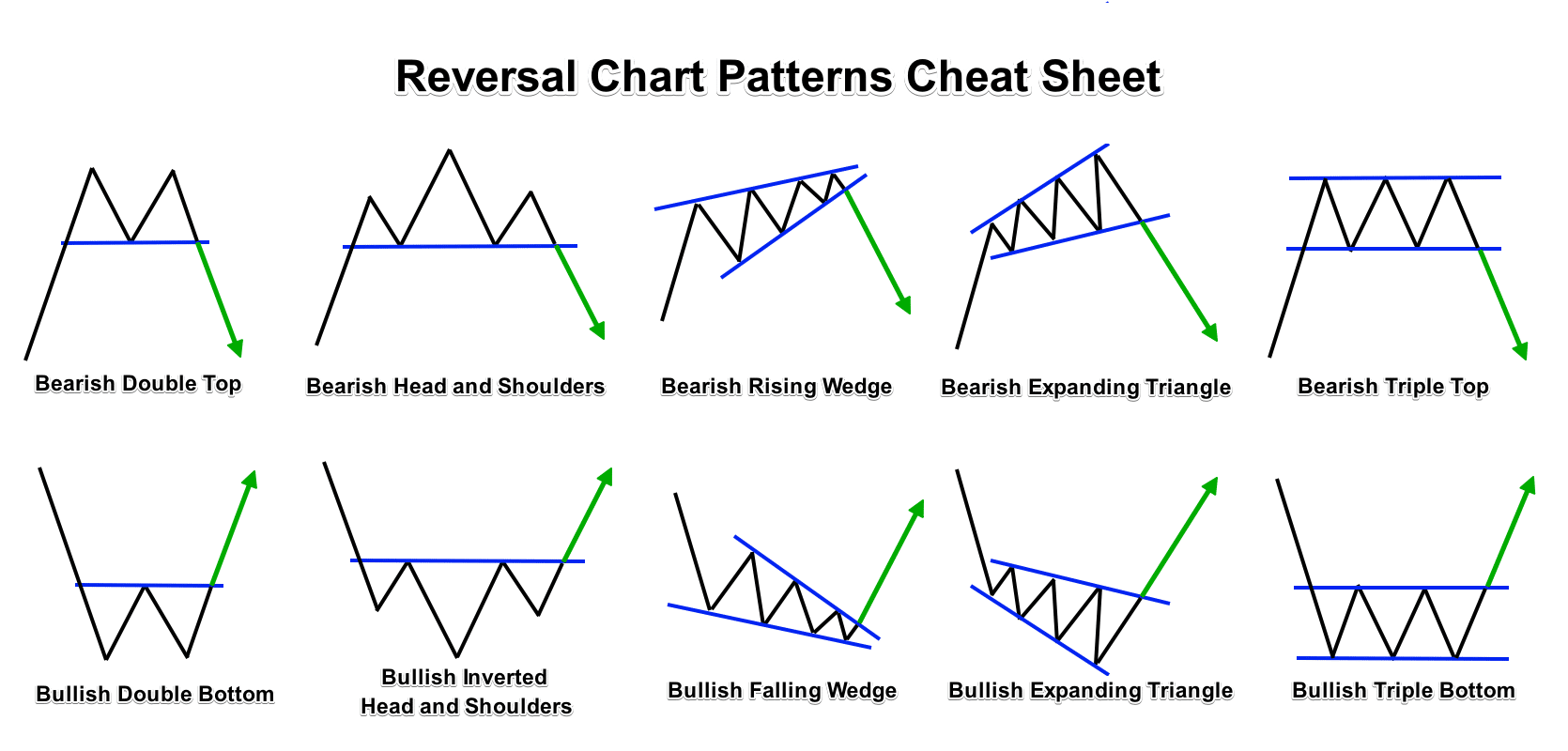

Reversal chart patterns signify a market trend reversal - from bullish to bearish or vice versa. The shapes of reversal chart patterns include: Double bottom and double top, Head and shoulders and inverted head and shoulders, Adam and Eve double bottom and Adam and Eve double top.

Reversal models in the forex market ForeX Technical Analysis & Analytics

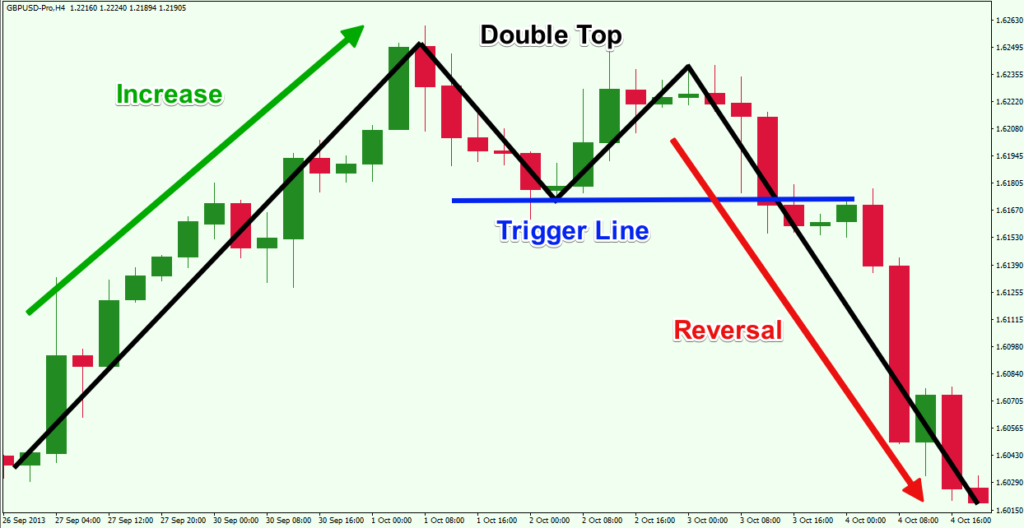

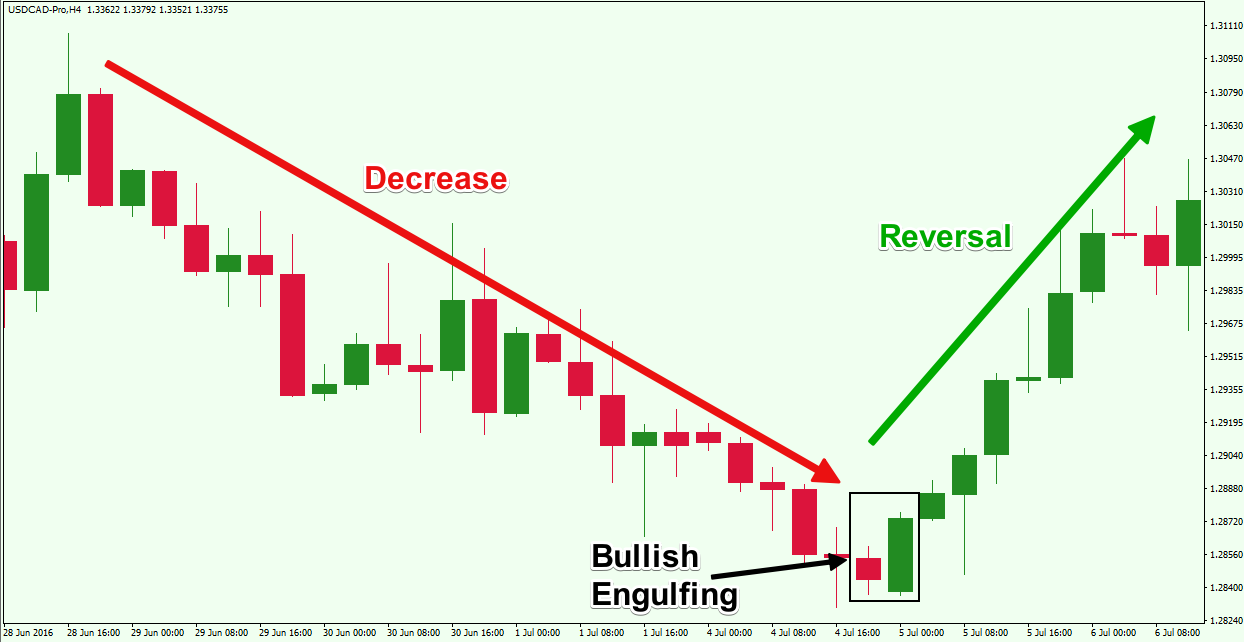

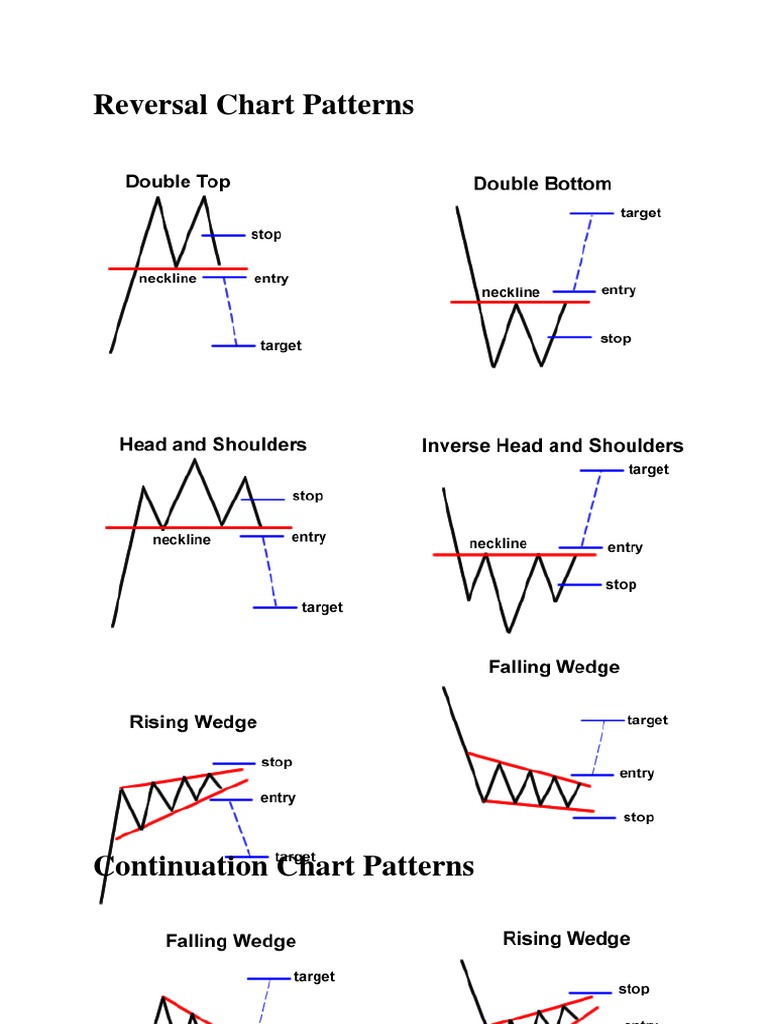

Reversal patterns refer to chart arrangements that happen before a chart starts a new trend. For example, a bullish reversal pattern will typically happen during a downward trend and lead to a new bullish trend. These patterns can help you make better decisions about when to enter a trade.

The Essential Guide To Reversal Chart Patterns TradingwithRayner

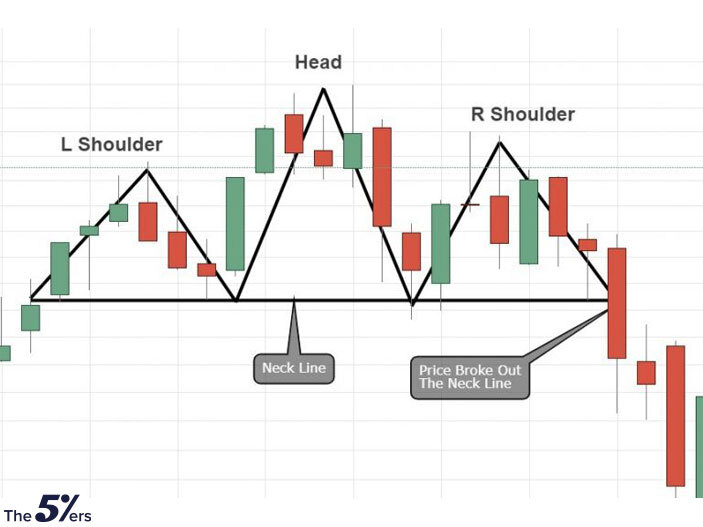

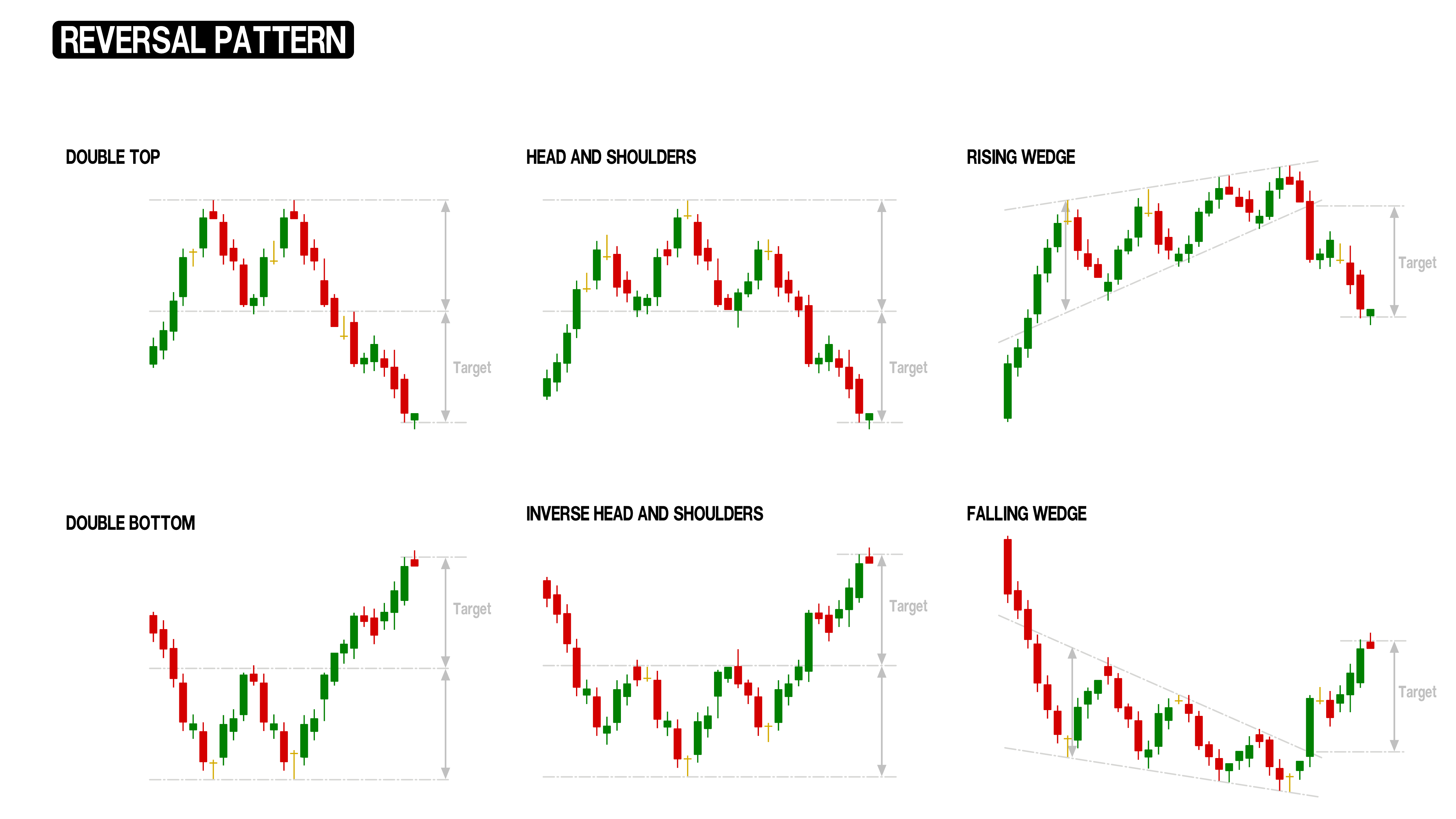

A reversal pattern indicates a change in direction from a rising market to a falling market and vice versa. We can use this pattern to predict the upcoming movement and open or close our trades accordingly. Head & Shoulders Pattern The Head &Shoulders pattern is a very unique reversal pattern.

📚Reversal Patterns How To Identify & Trade Them 📚 for FXEURUSD by

For example, chart patterns can be bullish or bearish or indicate a trend reversal, continuation, or ranging mode. And whether you are a beginner or advanced trader, you clearly want to have a PDF to get a view of all the chart patterns you want and need to use.

Five Powerful Reversal Patterns Every Trader Must know My Forex Signals

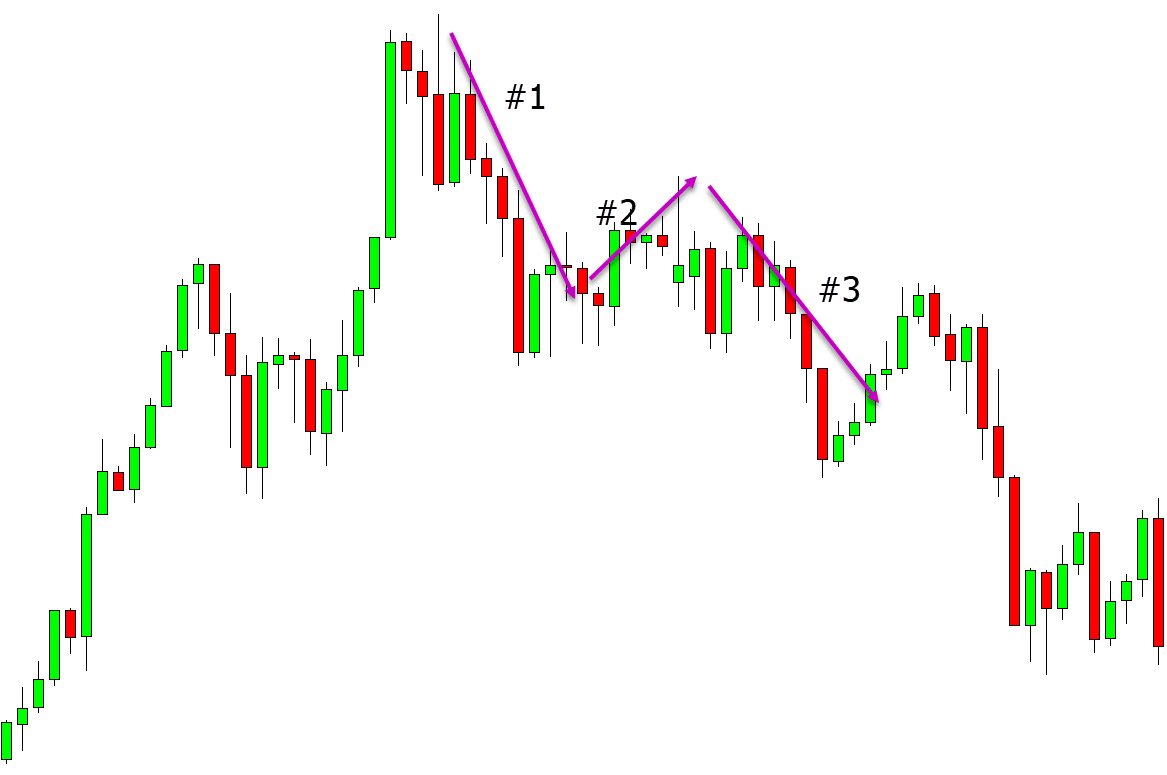

Step #3: Identify the trend-to-pattern ratio. The trend-to-pattern ratio is your next clue on this thrilling trading journey. Calculate the number of bars in the trend versus the trend reversal pattern. And as you can see: The trend reversal pattern is 3:1 so….

continuation reversal chart patterns Basic candlestick patterns

What are Reversal patterns? It's not complicated to figure out the reversal pattern. It indicates that a market trend will reverse once the pattern is finished. To understand easily, if you recognize a reversal chart pattern when the market moves in an uptrend, it probably implies that the stock price will start moving downwards.

Clone of The Essential Guide To Reversal Chart Patterns Crypto news

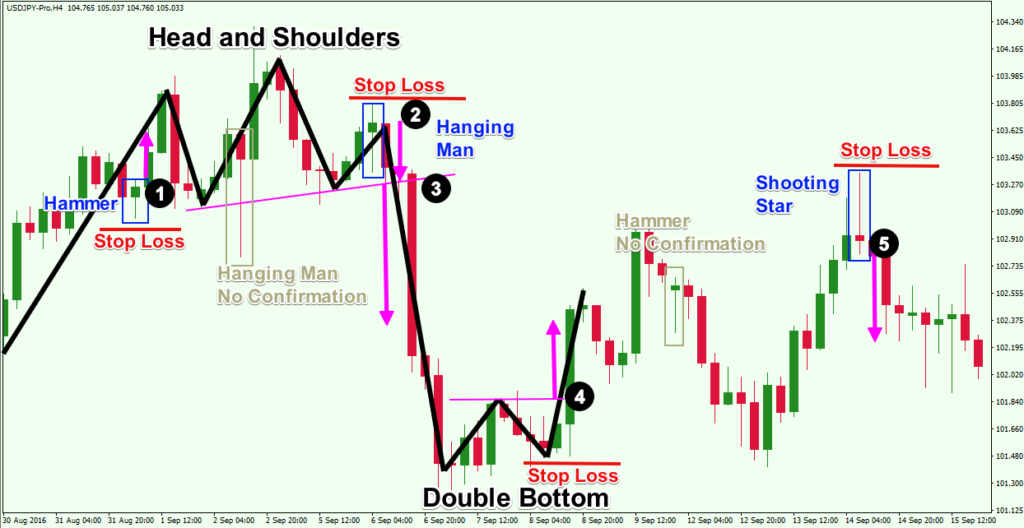

One of the most well-known reversal chart patterns is the Head and Shoulders. This pattern appears when a security's price experiences three peaks: a higher peak (the head) between two lower peaks (the shoulders). The Head and Shoulders pattern is completed when the price breaks below the neckline, which is drawn by connecting the lows of the.

The Best Trend Reversal Indicators and How to Use Them

A reversal pattern is a transitional phase that marks the turning point between a rising and a falling market. If prices have been advancing, the enthusiasm of buyers has outweighed the pessimism of sellers up to this point, and prices have risen accordingly.

Top Forex Reversal Patterns that Every Trader Should Know Forex

Some common reversal chart patterns are the inverse head and shoulders, ascending triangle, and double bottom. Reversal chart patterns can also be trend continuation patterns—the context is what matters. To trade a reversal, you want the chart pattern to have at least 80 candles and a buildup before the breakout level.

Reversal Forex Chart Patterns Cheat Sheet ForexBoat Trading Academy

When a price pattern signals a change in trend direction, it is known as a reversal pattern; a continuation pattern occurs when the trend continues in its existing direction following a.

Chart Patterns Continuation and Reversal Patterns AxiTrader

What Are Reversal Chart Patterns As the name suggests, trend reversal chart patterns indicate potential trend reversals or bounces after a sustained price move. Unlike continuation patterns, reversals mark a turning point in sentiment and momentum.

Reversal Chart Patterns

The 123 reversal chart pattern strategy is a three-swing price formation that indicates a potential reversal in trend. It is formed by three price swings or waves with three swing points, which is where the name of the pattern comes from. The 123 pattern reversal starts with the price swing not making the expected higher high (in an uptrend) or.

How to find and trade the 123 trend reversal pattern Artofit

What are Reversal Chart Patterns? In order to talk about reversal chart patterns, it needs to be preceded by a trend. The reversal pattern will then signal a reversal of the current trend. We have mentioned that the reversal pattern that occurs on the top of the trend is called a distribution and the reversal pattern that occurs at the bottom.

What Are Reversal Patterns & How To Trade With Them The Forex Geek

What are Reversal Patterns? Types of Reversal Patterns How to Trade Reversal Patterns? Three factors to consider before trading reversal patterns: Important Reversal Chart Patterns & How To Trade Them 1. Head and Shoulders 2. Inverse Head and Shoulders 3. Double Top 4. Double Bottom 5. Triple Top 6. Triple Bottom

Reversal Chart Patterns Cheat Sheet Candle Stick Trading Pattern

A reversal is anytime the trend direction of a stock or other type of asset changes. Being able to spot the potential of a reversal signals to a trader that they should consider exiting their.

Top Forex Reversal Patterns that Every Trader Should Know Forex

Here is a list of the reversal chart patterns: - Rising wedge / Falling wedge - Ascending broadening wedge / Descending broadening wedge - V bottom / V Top - Double Bottom / Double Top - Triple bottom / Triple top - Diamond bottom / Diamond top - H&Si / H&S - Rounding Bottom / Rounding top